AT&T TV Now subscribers and earnings

The question is whether the launch of HBO Max on May 27 can do anything about it

Q1 2020 | Q4 2019 | Q3 2019 | Q2 2019 | Q1 2019

Q1 2020 (April 22, 2020): HBO Max cometh

AT&T has released its earnings for the first quarter of 2020. Here's what you need to know:

- AT&T TV Now (the former DirecTV Now and AT&T's pure OTT streaming play) now has 788,000 subscribers. That's down nearly 48 percent from Q1 2019.

- And that's down from about 926,000 at the end of Q4 2019 — a loss of 138,000 subscribers.

- AT&T's other "premium TV" offerings are down nearly 17 percent year over year, and the net losses were up to nearly 65 percent year over year.

- HBO Max will launch on May 27.

Q4 2019 (Jan. 29, 2020): Get ready for HBO Max

AT&T today announced its earnings for the fourth quarter of 2019. Here's what you need to know:

- AT&T TV Now — formerly known as DirecTV Now — had a net loss of 219,000 subscribers for the quarter.

- That should take it down to around 926,000 subscribers in total.

- HBO Max is still on track to launch in May 2020.

- More than 10 million current HBO subscribers will be immediately offered HBO Max.

- Look for AT&T to leverage its upcoming 5G network to distribute HBO Max.

- AT&T says that it's in discussion with potential distribution partners, including MVPDs. (That means other services like YouTube TV, Hulu and Sling.)

- HBO Max also will be bundled with other AT&T-owned services, like mobile and broadband.

- Going forward, AT&T's video strategy will focus on AT&T TV (not AT&T TV Now) and HBO Max.

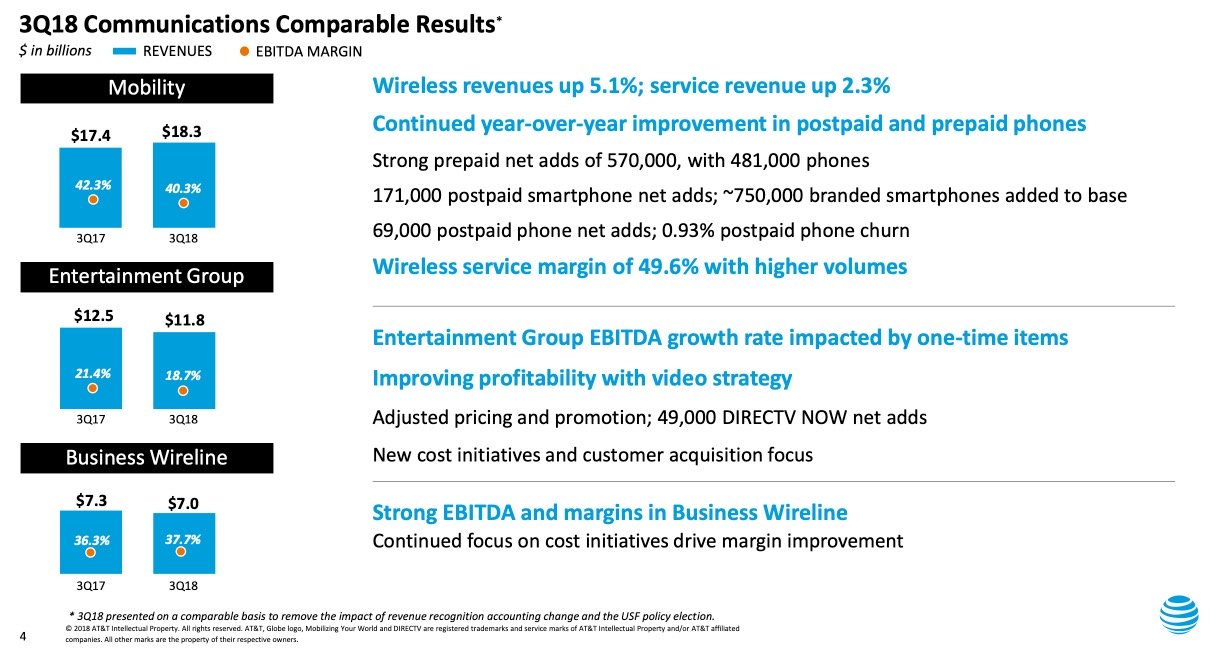

Q3 2019 (Oct. 28, 2019): Down to 1.1 million subscribers

AT&T on Oct. 28, 2019, announced its earninigs for the third quarter of the year. Here's what you need to know:

- AT&T TV Now — the former DirecTV Now — lost a net 195,000 subscribers in the three months ending Sept. 30.

- AT&T says that's because of "higher prices and less promotional activity."

- There are now 1.1 million AT&T TV Now subscribers.

- HBO Max is still coming — and AT&T will be giving more details at an investor event on Oct. 29.

Q2 2019 (July 24, 2019)

AT&T has announced its earnings for the second quarter of 2019. Here's what you need to know:

- DirecTV Now lost 168,000 net subscribers in Q2

- That should leave them with about 1.33 million subscribers

- And if estimates are correct, that means DirecTV Now has slipped to the fourth-largest streaming service in the U.S.

- AT&T TV — the skinny bundle with its own hardware — is slated to launch in test markets in Q3

- HBO Max is slated to launch in the spring of 2020

Q1 2019 (April 24, 3019): The hits, they keep on coming

AT&T has released its earnings for the first quarter of 2019. DirecTV Now still falls under the Entertainment Group. And as we expected, it was a rough quarter. Here's what you need to know:

- DirecTV Now lost 83,000 net subscribers for the quarter. That's way down from its Q4 2018 losses — about 69 percent less.

- That's due to price increases, the company says, plus fewer promotions.

- But ... the average revenue per user for DirecTV Now is now greater than $10.

- DirecTV Now now has a total of 1.5 million subscribers. That should keep it in the No. 2 spot .

- AT&T doesn't exact to lose as many in the second quarter, and says it should have a "decent" second half of the year.

- The Entertainment Group brought in $11.3 billion, down 0.9 percent year over year "due to declines in TV subscribers and legacy services."

- Total video subscribers were down by 627,000

- Premium TV subscribers lost 544,000 "due to an increase in customers rolling off promotional discounts, competition and lower gross adds due to a focus on long-term value customer base."

AT&T will announce its Q2 2019 earnings on July 24, 2019.

The latest updates, reviews and unmissable series to watch and more!

Q4 2018 (Jan. 30, 2019): Easy come, easy go

AT&T has released its Q4 2018 earnings for the company. DirecTV Now falls under the Entertainment Group. Here's what you need to know:

- DirecTV Now lost 267,000 subscribers for the quarter.

- That takes DirecTV Now down to about 1.57 million subscribers overall.

- "Traditional" video was hit even harder, losing 391,000 subs.

- The company attributes that to a scaling back of promotional prices and says no customers are on those discounted plans.

- Fewer customers are on entry-level plans, but higher tiers remained stable.

- More than a half-million accounts are on the WatchTV skinny bundle.

AT&T's Q1 2019 earnings will be released on April 24.

Q3 2018 (Oct. 24, 2018): DirecTV Now is up, video overall is down

AT&T announced its third-quarter earnings, which means we get a glimpse into the numbers behind a whole lot of things. But for our purposes here, it's DirecTV Now that we're really interested in.

Here's what you need to know:

- DirecTV Now saw 49,000 net additions in the third quarter.

- That should take its total subs to about 1.84 million subscribers.

- AT&T's entertainment group still saw a net loss of 346,000 "traditional video" subscribers. The satellite arm of DirecTV certain makes up a big chunk of that.

- AT&T confirms that it's beginning to "beta test a new streaming video device."

- That new device has been known since the spring , but exactly what it will be — and why you'd want a box from AT&T instead of, say, Amazon or Roku — remains to be seen.

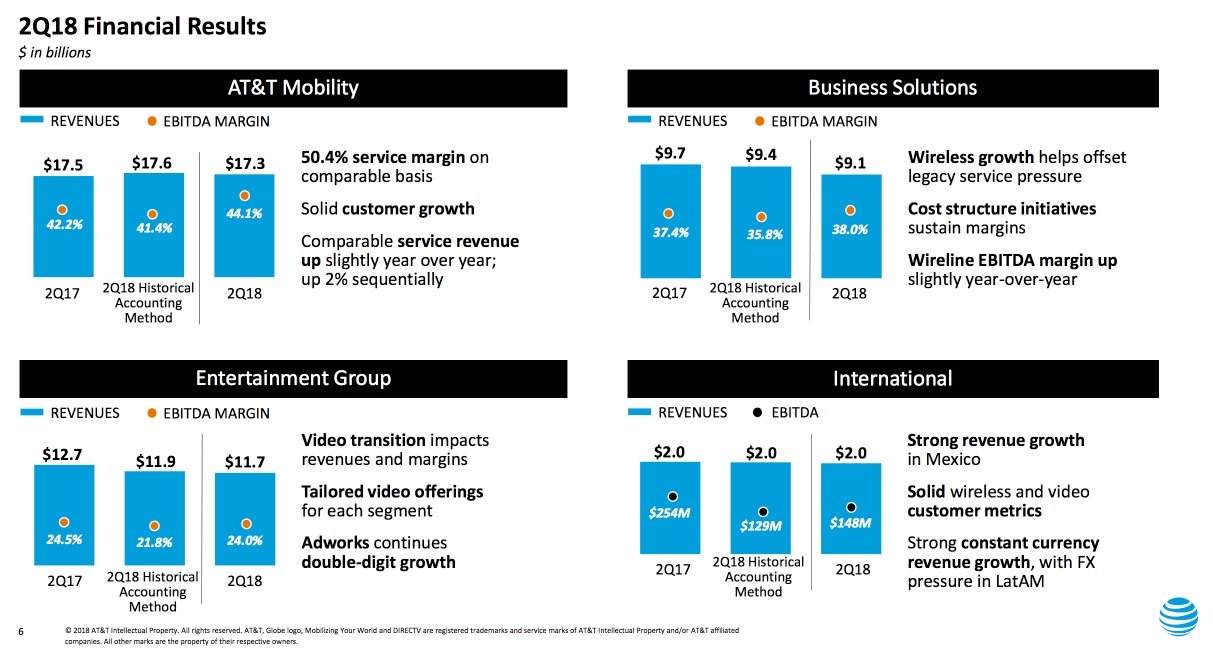

Q2 2018 (July 24, 2018): Enter the Entertainment Group

AT&T today announced its earnings for the second quarter of 2018 . And as you'd expect, streaming video is having a pretty big impact on the bottom line.

Here are the big strokes, of interest to cord-cutters:

- AT&T's Entertainment Group — of which DirecTV Now is a part — saw 342,000 net additions in the second quarter

- That gives DirecTV Now a total of 1.8 million subscribers (up from 1.5 million in Q1)

- But total video subscribers were up by just 80,000 for the quarter

- DirecTV satellite subscribers continue to switch elsewhere, losing 286,000 customers

The delivery mechanisms are just a few parts of what AT&T is doing today, though, particularly after AT&T's purchase of Time Warner in Q2. Look for more original programming from the newly formed Warner Media properties, and new features (and new revenue streams) from all of AT&T's assets.